Buy Now, Pay Later Companies vs. Traditional Lending: What’s the Future of Finance?

by Albert Boyle

The Future of Business Finance

Buy now, pay later (BNPL) has transformed consumer financing options and could soon do the same for business payments. New market entrants like Ratio Tech, Hokodo, Mondu, Biller, and TreviPay are offering B2B BNPL options that have gained attention and investment.

History of B2B BNPL

B2B BNPL is a new form of trade credit that improves the shopping experience for buyers. It uses open banking data, behavioral analytics, and risk modeling to enable real-time credit decisions and payment-to-collection risk transfer. This is a significant improvement over traditional models that rely solely on business data for credit evaluation, which can be time-consuming.

Small and midsize enterprises (SMEs) are particularly interested in B2B BNPL due to the challenges they face in obtaining financing. With a high rejection rate of 40%, SMEs are eager for alternative payment options. Many SMEs only have three months' worth of cash reserves, and B2B BNPL can help bridge the gap until accounts receivable are replenished.

Unlike consumer-level BNPL solutions that rely on existing credit cards, B2B BNPL solutions require more effort for business buyers in terms of verification and credit history. This leads providers to charge higher transaction fees than credit card companies.

The Advantages of Revenue-Based Financing (RBF)

As the B2B BNPL market matures, new players are emerging with different business models. Some companies offer extensive merchant and marketplace coverage, while others use open banking or investor funding models to streamline the onboarding process. Regardless of the model, all B2B BNPL solutions must address the risks associated with irresponsible borrowing by businesses.

RBF (revenue-based financing) transactions offer numerous advantages for businesses, including accessing capital without diluting ownership, lowering the cost of capital, improving financial flexibility, and meeting the challenges of funding business growth during times of high inflation. RBF transactions also provide sellers with more flexibility in choosing contracts and offer protection against liabilities in bankruptcy proceedings.

Disruption in B2B BNPL Financing

Business buyers have lagged behind in adopting modernized financing solutions, creating a demand for B2B BNPL options that offer flexible payment terms. B2B BNPL financing allows business buyers to spread out payments over time, improving cash flow for SMEs. This financing method also enables sellers to increase sales to segments not covered by traditional net terms or invoice factoring solutions.

What sets BNPL apart is its innovative credit and risk-sharing model. Suppliers transfer the burden of credit risk and identity verification onto third-party providers, reducing sellers' cost of capital and the need for multiple third-party partners. BNPL companies also offer real-time funding, allowing business buyers to purchase more inventory and accelerate their growth.

Ratio Tech, a Forefront B2B BNPL Provider

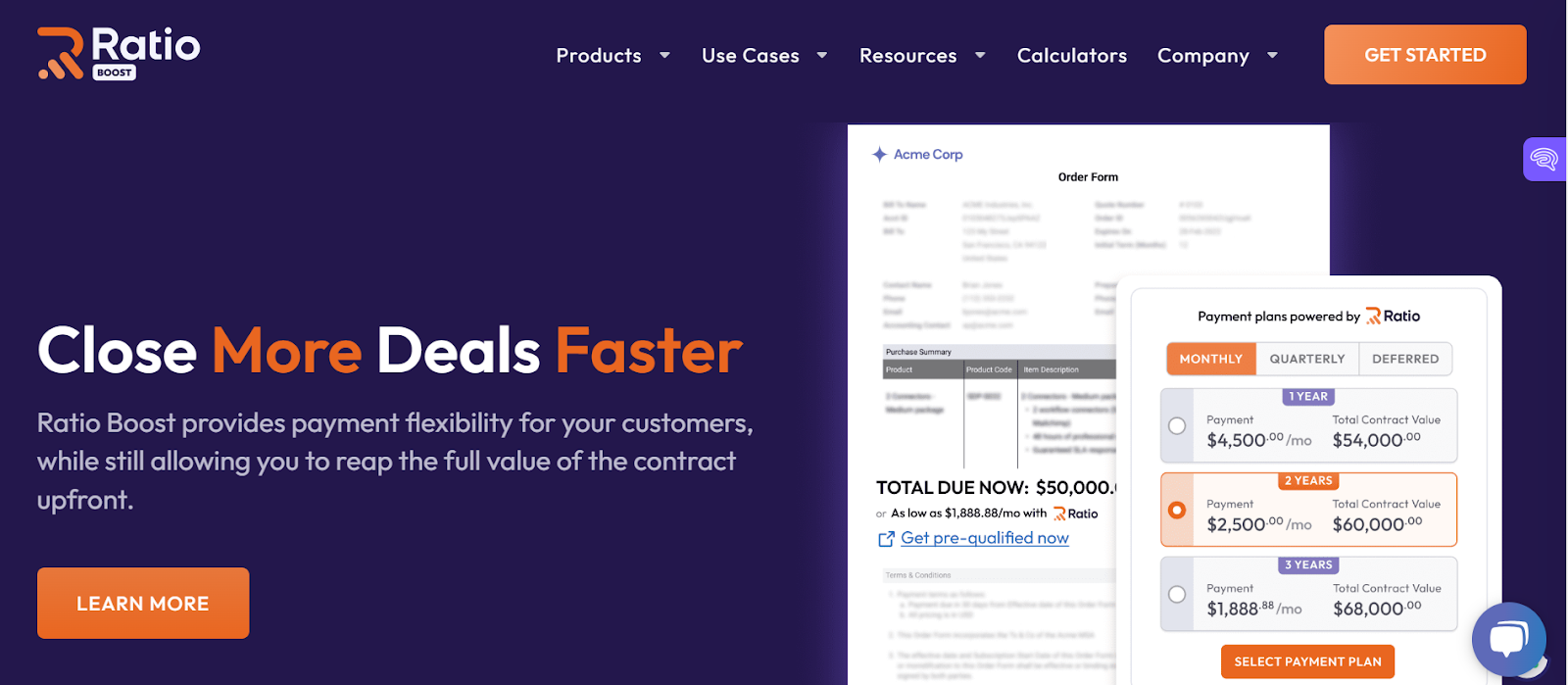

Ratio Tech, a leading provider of financial technology solutions, is at the forefront of this B2B BNPL revolution. Their cutting-edge platform seamlessly integrates with businesses of all sizes, offering tailor-made BNPL solutions. By harnessing the power of Ratio Tech's platform, businesses can provide their customers with flexible payment options, improve cash flow, and boost sales.

Ratio Tech's innovative approach leverages advanced data analytics and risk assessment techniques to ensure responsible lending practices. This not only benefits sellers but also safeguards buyers against irresponsible borrowing. With Ratio Tech's solutions, businesses can navigate the evolving landscape of B2B finance with confidence.

The Future of Business Finance

In conclusion, BNPL has revolutionized consumer markets and is now poised to make a significant impact in B2B commerce. B2B BNPL can improve cash flow, mitigate risk, reduce invoice delays, and help small businesses access credit they might otherwise be denied. As banks and credit cards face competition from BNPL, it's clear that traditional models will need to adapt to the changing landscape.

The Future of Business Finance Buy now, pay later (BNPL) has transformed consumer financing options and could soon do the same for business payments. New market entrants like Ratio Tech, Hokodo, Mondu, Biller, and TreviPay are offering B2B BNPL options that have gained attention and investment. History of B2B BNPL B2B BNPL is a new…

Recent Posts

- Understanding The Importance Of Professional Tree Care Services: An Insight Into Stokes Tree Solutions

- Expert Cleaners Lexington: Delivering Excellence in Cleaning Services

- Choosing the Right Grass: A Guide to Grass Types and Ideal Mowing Practices with Green Lawns Solutions

- Cracking the Code: Unveiling the Best Personal Trainer in Maine

- Maine’s Fitness Frontier: How to Select Your Ideal Personal Trainer